Industry performance: Supply, demand and external factors

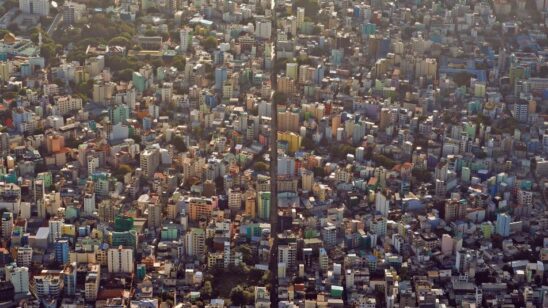

[vc_row][vc_column][vc_column_text]As of the end of November 2017, arrivals are up by 6.8% with Europe registering the largest increase compared to the previous year. European arrivals increased by 11.3% year-on-year. Looking at specific regions in Europe, Central and Eastern Europe, which includes Russia, registered a growth of 23.4%.

Russia is the biggest contributor to this growth with an increase of over 32%. The traditional markets continue to show steady growth; while arrivals from the United Kingdom and Germany is slightly up, the year 2017 has seen arrivals from Italy up by 23% compared to the same period last year.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_single_image image=”17435″ img_size=”full”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The Asia Pacific market has almost remained the same, registering a growth of less than 2%, stabilized by the significant growth of arrivals from India (23%) and South Korea (16%). The tourism powerhouse for the country during the last few years, China shows a decline of 7%, although arrivals from China contributed 23% of all arrivals to the Maldives.

Overall this doesn’t paint a bad picture, but the industry’s main concern today is their occupancy and ADR and more specifically their RevPAR. Are we supplying too much at too low a price? Is the growth in supply outweighing demand and has the price dynamics of the industry changed due to the change in its composition during the last few years? Or are we being affected by changes in the global markets?

Several new resorts have opened in 2017 and the guesthouse sector continues to expand rapidly. During the last five years, guesthouse beds have recorded a compound annual growth of 50.1%. According to the latest published figures, there were 472 guesthouses with a bed capacity of 7,360 as at end November 2017. Bed capacity in guesthouses registered a growth of 20% during the first eleven months of the year. Meanwhile, the resort sector added almost 2,000 beds to its inventory.

The increase in the supply of resort bed in 2017 outweighed the increase in demand, with supply increasing by 2.9% as at end of September and demand falling by 0.2% leading to a 3% fall in resort occupancy. Meanwhile, the number of beds across all segments increased by 14.3% as at end November 2017 reaching 38,412, while bed nights increased by 9.3% during the same period. Overall occupancy for the period fell by 2.6%.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_single_image image=”17433″ img_size=”full”][/vc_column][vc_column width=”1/2″][vc_column_text]While there is a concern in the industry about the rates, the overall picture for the resort sector shows a somewhat positive picture. The resort sector recorded a 4.4% increase in RevPAR (Revenue per Available Room) for the first nine months of 2017. This is a significant change considering that RevPAR has declined for two consecutive years in 2015 and 2016.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]The sector registered a RevPAR of US$390 for the first nine months of 2017 with April marking the highest RevPAR growth so far this year, up 32.9% to US$526.

The increase is driven by a low basis of comparison with last year and may still have a lot of catching up when compared to the best years of the industry. The increase in RevPAR is mainly a result of the increase in ADR (Average Daily Room Rate), up by 7.6% to US$628 during the period. Rates have declined in 2015 and 2016 and these figures certainly indicate a positive turn for the market as a whole.

Several new luxury resorts have opened over the past year, meaning more rooms available in the market at higher price points. This could be one of the main factors that have contributed to the growth in ADR. With several new resorts under construction, the Maldives is set to add 2,500 more rooms to its existing hotel supply in the next three years, mostly in the luxury category.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_single_image image=”17431″ img_size=”full”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]As the increase in ADR and RevPAR has likely been driven by high-end resorts with higher rates, the increase in ADR and RevPAR for the year most likely would not have benefitted all in the industry equally and hence may have faced challenges in maintaining their financial performance.

However, the overall market is showing signs of recovery. The industry could take comfort in the fact that arrivals have grown and that the Maldives still remains one of the most desired destinations in the major source markets. The increase in RevPAR and ADR indicates that the markets are positive and that there is scope for growth.

The Maldives is a luxury destination and changes in politics and economic trends and the value of currencies in the source markets are bound to have significant effects on how the industry performs. The value of the Russian Ruble is certainly a contributing factor to the significant improvement of the Russian market during the first eleven months of the year, registering a growth of 32.7% for the period.

One other important factor that contributes to the industry’s performance is the changes in other similar destinations and how they are performing. While their performance would also reflect the same external factors that affect the Maldives, their performance would also affect the Maldives directly.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text]Several competing destinations such as Fiji, French Polynesia, Indonesia and Thailand are growing in popularity. Phuket in Thailand registered a decline in RevPAR of 5.5% following the political issues brought on by the coup d’état in 2014.

However, since then, it has recovered with demand up by 6.1% in 2015 and 9.7% in 2016.[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_single_image image=”17434″ img_size=”full”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Bali has seen a significant performance in 2017. During the first nine months of the year, the destination registered an increase in occupancy of 9.6% achieving 72.2%. ADR grew by 1.4% and increase in demand (12.4%), significantly outweighed the growth in supply (2.6%).

The performance of the destination has been fuelled by a massive increase in Chinese arrivals that registered an increase of 58%, year on year, reaching one million for the first eight months of 2017. Apart from being a popular holiday destination, Bali has also achieved significance as a MICE destination during the last five years.

The Maldives tourism product has seen significant changes since its inception. The client profile has changed over the years with significant changes not only in their nationality but also in the tourism product they seek. The offer of sun, sea and sand with the country’s unique selling point of one island one resort has remained the country’s most significant attraction over these changes.

With the huge investments that are being made in the industry today, the face of the industry is bound to change further, with the country being able to offer more options not in prices but also in what tourists can enjoy in the Maldives. These changes combined with the long-awaited development of new infrastructure such as Velana International Airport that would have the capacity to receive 7 million arrivals in a year, would provide fuel for growth in the next few years.[/vc_column_text][/vc_column][/vc_row]