Subscription Services Emerge as a Travel Industry Recovery Trend: GlobalData

The popularity of subscription services could rise in the travel industry as businesses find it a compelling strategy to build brand loyalty, states the leading data and analytics company GlobalData.

Hannah Free, Travel and Tourism Analyst at GlobalData, comments: “More and more businesses are moving away from the traditional product economy to the ‘subscription economy’. The subscription economy refers to the increasing presence of subscription-based businesses in today’s ecommerce landscape as opposed to the traditional pay-per-product model. Subscription models have the potential to completely transform an industry that faces challenges such as seasonality and growth-decline cycles by ensuring a relatively stable revenue stream.”

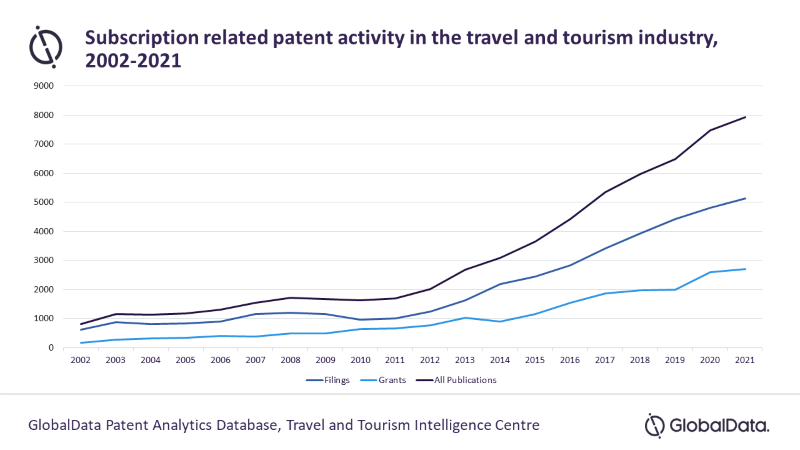

Further demonstrating the shift from traditional loyalty points to subscriptions is increased patent activity for subscriptions growing at a compound annual growth rate (CAGR) of 10.4 per cent between 2017 and 2021. According to GlobalData’s Travel and Tourism Patent Analytics, a total of 7,936 patent publications related to subscriptions were made in 2021, with growth continuing even throughout COVID-19. Travel companies investing in subscription services will emerge from the pandemic in a strong position to attract the tech savvy and deal finding travellers.

Some companies integrate subscriptions to their mix of revenue streams, while others will go to market with it as a foundational offering. Regardless, COVID-19 has highlighted the need for more a predictable and recurring revenue stream for travel companies as the likes of Bookings Holdings and Expedia Group saw their revenues drop more than 50 per cent YoY in 2020, when travel came to a virtual standstill.

Free concludes: “Subscriptions represent a compelling way for travel companies to create lasting relationships where engagement typically ends after a one-off transactional purchase. According to GlobalData’s Q1 2021 Consumer Survey, 35 per cent of global respondents consider time-saving a key factor driving purchase, while 46 per cent consider time-saving nice to have, but not essential. The subscription model is well placed to capitalize on increasing consumer demands for personalization, while the value and convenience enjoyed by members has the potential to outweigh a monthly subscription or membership fee.”