Exploring the Dynamics: Analysis and Projection of Employment Ratio in the Maldivian Tourism Sector

Editor’s Note:

We are pleased to present the research paper titled “Exploring the Dynamics: Analysis and Projection of Employment Ratio in the Maldivian Tourism Sector,” which offers a meticulous examination of workforce dynamics in the Maldivian tourism industry, shedding light on local and expatriate employment ratios. This study, led by Ahmed Ibrahim, Aishath Thashkeel, Dr. Byju KPM, and Dr. Ahsan Ahmed Jaleel, adopts a blend of quantitative and qualitative methodologies, drawing insights from the 2022 Census and other pertinent data sources. While acknowledging the inherent uncertainties in findings and projections, this research provides invaluable perspectives for stakeholders, policymakers, and researchers as they navigate the industry’s evolution. This publication serves as a cornerstone for comprehending and addressing employment challenges within the Maldivian tourism sector, thereby fostering its sustainable growth and development. We express our sincere appreciation to the authors and contributors for their dedicated efforts and valuable insights in crafting this comprehensive study, and for granting us permission to publish it.

Executive Summary

This study aimed to assess the viability of sustaining the existing employment ratio in the tourism sector. Utilizing secondary data from publicly available sources, primarily derived from the 2022 Census, the study recommends a ratio of approximately 30:70 (local to expatriate). This is considering the demographic challenges affecting the labor market in the Maldives over the next five years, compared with the industry’s growth rate.

As per the Census 2022 data, Maldivians employed in the tourism industry stands at 22,244. The National Skills Development Corporation, in its report titled “Developing a National Skills Development Master Plan,” forecasted a growth rate for the tourism industry ranging from 25% to 35%. Applying this growth projection, the anticipated job opportunities in the tourism sector over the next five years (2022–2027) range between 14,461 and 20,245 new positions.

Based on the demographic data from Census 2022, the present working-age population (18-64 years) stands at 248,207. Looking ahead to 2027, the retirement of individuals aged 60-64 and the influx of new entrants from the 13-17 age group will contribute an additional 18,658 Maldivians to the workforce. Given that the tourism industry constitutes 13.07% of the overall workforce, as indicated by Census 2022 data, it is projected that 2,439 individuals will join the tourism sector as new entrants.

Therefore, by the end of 2027, the aggregate of existing and newly created job opportunities is projected to reach 78,087. Nonetheless, the local workforce, encompassing both existing (22,244) and new entrants (2,439), stands at 24,683. This results in a substantial gap of 55,404 jobs that necessitate fulfillment by expatriates. Consequently, the anticipated local to expatriate ratio is projected to be 32:68.

Overview of the Study

This project was undertaken to understand the intricacies of the varied employment challenges and issues found within the Maldivian tourism sector. A robust methodology was adopted, combining primary and secondary data through a triangulation approach. The study employed an explanatory quantitative design, aiming for 70 responses but obtained 53 through cluster sampling. Simultaneously, an exploratory qualitative study involved 16 HR department representing 80 tourist establishments were interviewed to delve deeper into operational complexities.

This methodological synthesis sought to capitalize on the strengths of both approaches, providing a comprehensive understanding of the tourism operations’ perspectives.

A Snapshot of Maldivian Tourism Sector

The Maldives’ tourism industry serves as a primary driver of the country’s GDP, contributing significantly through employment creation. While the tourism and hospitality sectors have exhibited consistent annual growth, a substantial shortage of local manpower for tourism services persists alongside the growing number of tourists. According to the Ministry of Tourism, as of 16th January 2024, Maldives has welcomed 96,077 tourists, representing a growth of 10.2% compared to 2023. According to a publication by the Asian Development Bank, in 2022, the tourism industry directly constitutes for over 20% of the country’s GDP and have had a projected indirect contribution of 79%.

This underscores the pivotal role of the industry in the Maldivian economy. This aligns with the conclusions drawn in the Training Needs Analysis for Tourism Sector published by Ministry of Higher Education in 2020. According to this report, tourism-related activities form a comprehensive spectrum, including transportation, accommodation, food and beverage services, diving, water sports, entertainment, handicrafts, and organized leisure activities within the Maldives’ tourism value chain.

The most recent data relating to employment in the tourism industry is derived from the 2022 Census conducted by the Maldives Bureau of Statistics (MBS). MBS employs the International Standard Industrial Classification of All Economic Activities (ISIC, Rev 4) to define the tourism industry, which is described as ‘provision of short-stay accommodation for visitors and other travelers & longer-term accommodation for students, workers & similar individuals’. In the Maldivian context, this definition encompasses resorts, hotels, guest houses, tourist vessels, yacht marina.

The subsequent section of this report presents research findings in a tabular format.

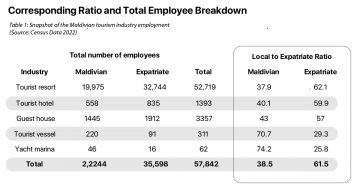

Table 1: Snapshot of the Maldivian tourism industry employment (Source: Census Data 2022)

The table delineates the sub-sectors within the tourism industry, providing a breakdown of local and expatriate numbers in each segment. Notably, the local ratio is markedly higher in the tourist vessel and yacht marina categories. Conversely, in resorts and hotels, the local ratio falls below 40%.

Table 2 is the distribution of the local-to-expatriate workforce in the Maldives.

Presently, the Maldivian-to-Expat ratio is at 38.5:61.5, with the tourism sector constituting 13.07% of the total workforce in the Maldives.

Table 3 is a summary of the age-wise distribution of the local workforce.

The total working population in the Maldives comprises 372,431 individuals aged 18 to 64, with 248,207 being Maldivians and 129,504 foreigners. The anticipated growth in the workforce is influenced by individuals aged 13 to 17, who could potentially fill positions vacated by the retiring

60 to 64 age group in five years. In 2027, the projected net increase of Maldivian entrants is 18,658, calculated as the difference between 32,036 (ages 13 to 17) and 13,378 (ages 60 to 64).

Derived from the projected net entrants of locals, the study anticipates that 2,439 individuals will enter the tourism industry by 2027. This calculation is grounded in the current percentage of the total local workforce, as depicted in Table 2.

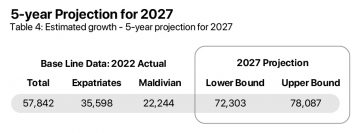

Therefore, based on this data, Table 4 shows the anticipated growth in the tourism sector projected over a span of five years.

The table outlines the 2027 growth rate projection, incorporating a 95% confidence interval to accommodate a potential 5% margin of error in growth rate calculations. It establishes both lower and upper limits, accounting for possible fluctuations or errors in predictions. The data indicates that, for the tourism industry, potential new job opportunities by the end of 2027 could range between 72,303 (lower limit) and 78,087 (upper limit).

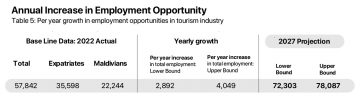

To break this down further, Table 5 is a summary of the annual increase in employment opportunities in the tourism industry.

The table above shows the yearly expansion of employment opportunities in the tourism industry, fluctuating between a minimum of 5% and a maximum of 7%. This rate is taken from Maldives National Skills Development Authority Analysis published in the report Developing a National Skill Development Master Plan (2020). This translates to an annual increase in employment opportunities within the tourism sector, ranging from 2,892 to 4,049.

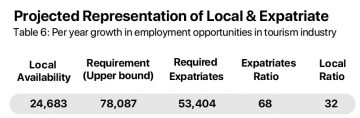

Table 6: Per year growth in employment opportunities in tourism industry

The above table explains the anticipated local-to-expatriate ratio by the end of 2027. Computed from the upper-bound data on new job opportunities in the tourism sector and the projected Maldivian entrants, it reveals that out of the 78,087 potential new positions, only 2,349 Maldivians are expected to join, resulting in a local-to-expat ratio of 32:68.

Therefore, table 7 provides a summary of the study’s key findings.

Recommendations

Considering the study’s findings, the subsequent recommendations are put forth for the tourism sector to incentivize greater local participation. These align with the recommendations in the Maldives Fifth Tourism Master Plan (2023 – 2027).

- Change the local-to-expat ratio based on the findings

- Devise, implement and monitor strategies to attract and retain locals in the tourism and hospitality sector.

- Vocational training institutes, schools, and higher education institutions to offer training and development opportunities to enrich the skill set of employee These initiatives must focus on cultivation of technical and soft skills, as well as providing knowledge enhancement and training in behavioral and attitude development.

- The relevant government authorities to establish scholarship and fellowship programs, providing eligible students and employees with opportunities to pursue higher education and gain practical experience in the fie

- To investigate alternative work arrangements, such as freelancing, contracting, and gig economy principles with a particular focus on encouraging women to join back- of-the-house departments like finance, HR, marketing, and sale This initiative involves the adoption of digital platforms that facilitate a hybrid working model.

- Establishing an all-encompassing digital platform that serves as a one-stop destination for industry-related job listings and comprehensive skill and career development information.

- Incorporate tourism and hospitality values, concepts, and knowledge into the school curriculum.

Conclusion

This study employs various methods to delineate the existing and potential local-to-expatriate ratios in the tourism sector, projecting insights for 2027. The findings underscore the unsustainability of the current ratio in the Maldives, urging a revision to align with evolving labor market dynamics.

Future studies in this domain could concentrate on analyzing the impacts on the tourism sector resulting from the observed ratio changes in this study. Additionally, as the study delves into the employment of locals, it becomes crucial to understand the challenges associated with attracting, developing, and retaining local talent in the tourism sector. Finally, exploring gaps in the skills, knowledge, and expertise of locally available workforces, encompassing their attitudes and work ethic, holds equal significance as it directly influences employability.