Asia Pacific hotels continue to weather the COVID-19 storm

The Asia Pacific hotel industry was riding high in 2019. Tourism from both the business and leisure travel segment was firing on all cylinders. The continued growth in outbound China tourism had created numerous large revenue streams. And there were strong expectations for the robust momentum in MICE sector through events like the Singapore Airshow and Tokyo 2020 Olympics.

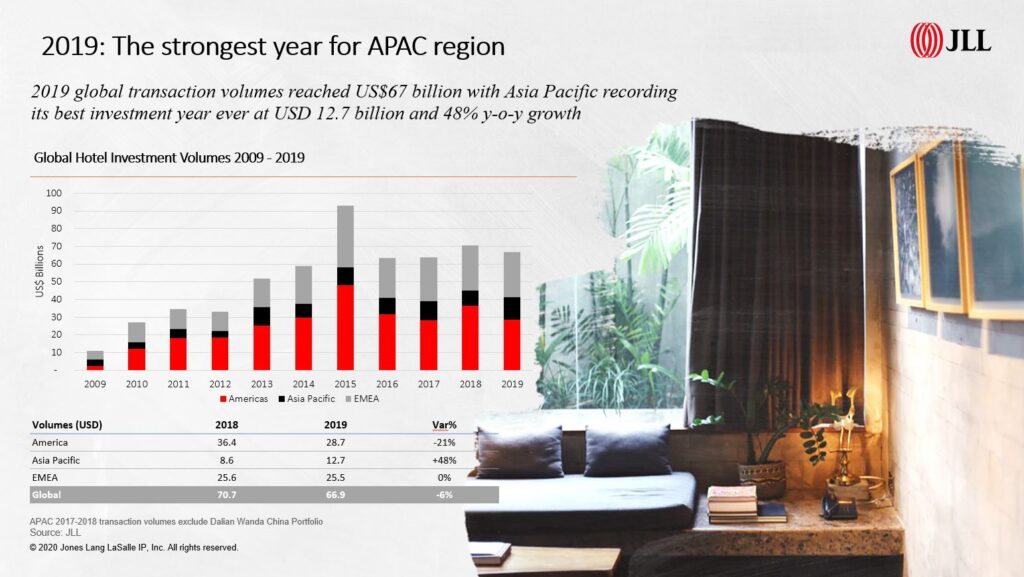

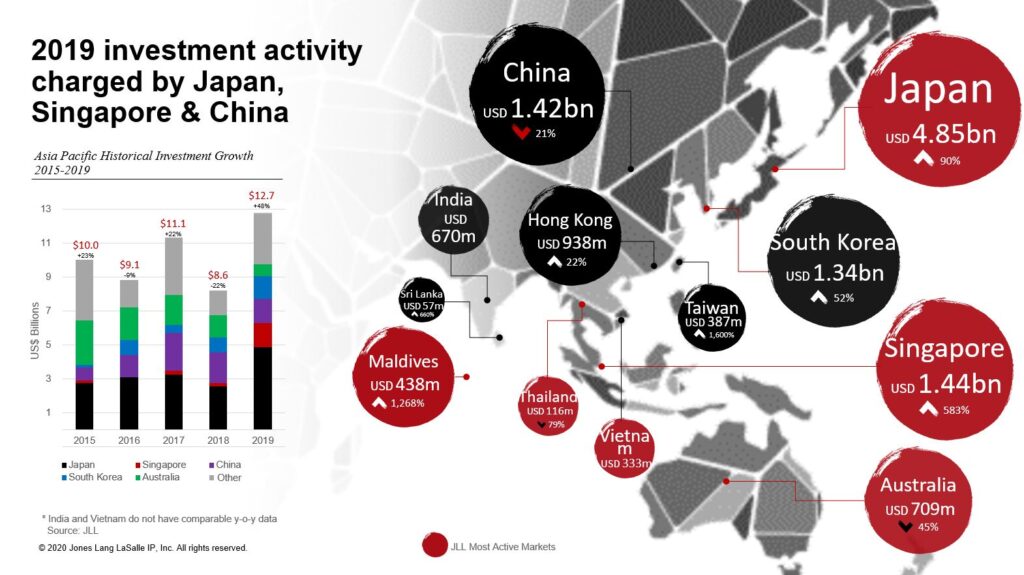

Investors saw all this. Hotel transactions registered its highest recorded full-year levels in Asia Pacific, finishing the year at $12.7 billion in sales and roughly 50% year-on-year growth. This full-year performance contrasted with EMEA, where uncertainty principally around Brexit led to a flatlining of growth, and with the Americas, where there was a decline in volumes as late-cycle sales slowed down and portfolio sales stalled.

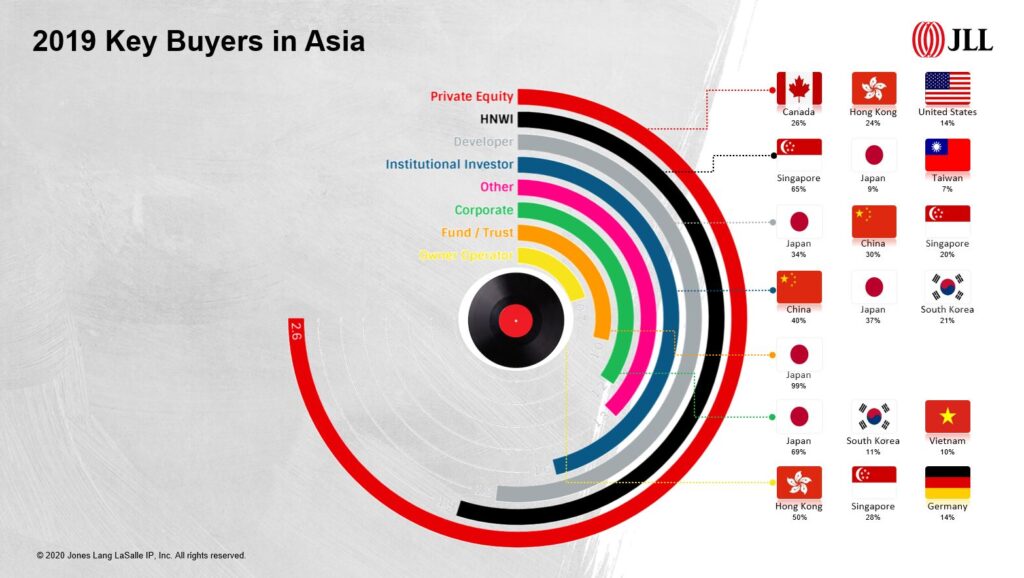

Encouragingly, investor activity was fuelled by appetite across all buyer categories and demand across all major geographies. In particular, private equity and high net worth buyers paved the way as they have done previously on acquisitions. In short, on the back of this 2019 performance, our 2020 projections were very much in line, with the possibility of some economic and political headwinds potentially influencing how investors would underwrite their investment thesis, especially around cap rate movement and market growth expectations going forward.

Sitting where we are now, amid the COVID-19 pandemic, no one would have foreseen such a night-and-day situation. Our much-beloved industry has regrettably turned into a poster child within the pandemic as one of the hardest-hit sectors due to travel restrictions.

It’s hard to argue this fact. From an operations perspective, many hotels in Asia Pacific, with lockdown liftings uncertain, are recording gross operating losses. Elsewhere, some hotels are opting to close doors and place unpaid staff on leave.

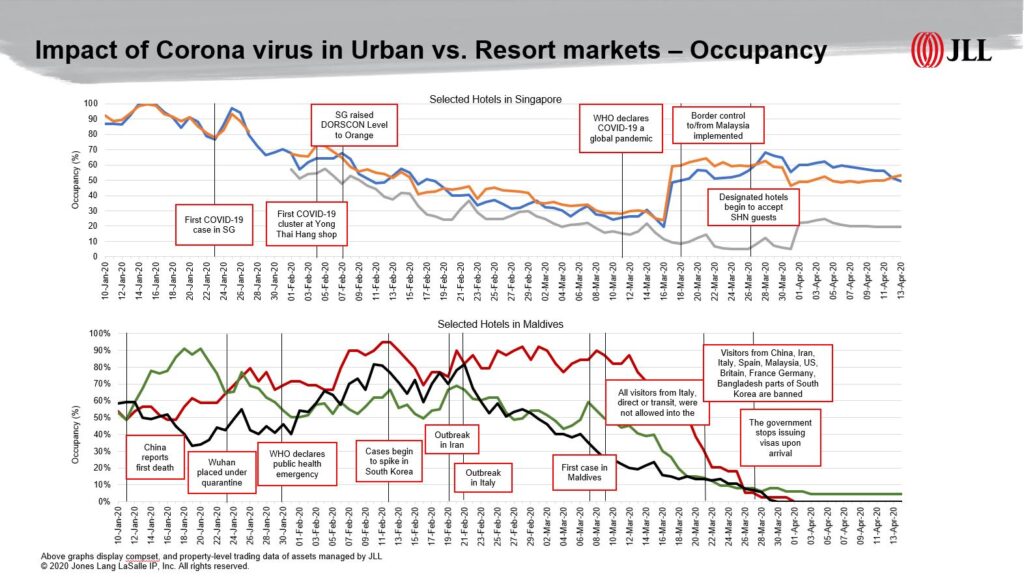

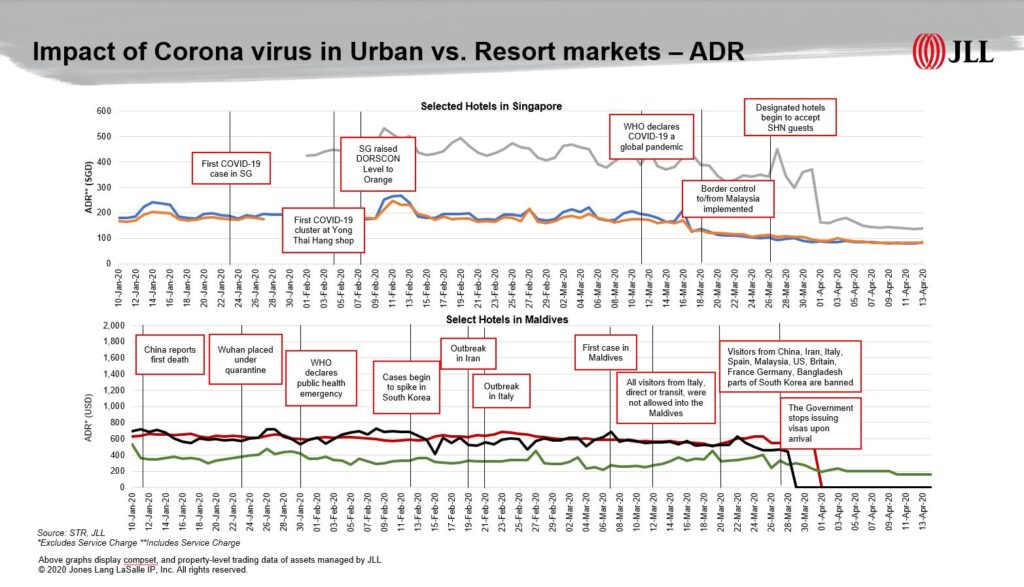

Occupancy rates in Singapore, as a gateway city, and the Maldives, as a gateway resort destination, show the impact, but also provide some optics into how a recovery could present.

In Singapore, we saw occupancy levels decline from a peak of 90% in January to between 15-30% on March 11 when the World Health Organisation (WHO) classified COVID-19 as a global pandemic. Following the WHO’s announcement, and the introduction of travel clampdowns, occupancy in Singapore declined further to roughly between 10-15%.

More recently, several hotels have seen a rebound due to business coming from stranded Malaysians, who are employed by local companies or returning travellers, who are serving mandatory stay-at-home notices in hotels for periods of two weeks.

By contrast, in the Maldives, occupancy levels fluctuated more than Singapore. Hotels that were reliant on China inbound demand saw an almost immediate drop-off and would have struggled to replace that business so quickly from other source markets. The resorts that focused on European winter travellers felt the pinch a little later in this situation, only observing a drop-off in late February before a more pronounced decline in March after the country formally recorded its first case. The Maldives effectively closed its border, and hotels were forced to shut, albeit a few resorts that have remained open to service existing guests.

Using these two markets as benchmarks, the big question now on everyone’s minds is how recovery will present and what role will investors play, given their record appetite for Asia Pacific hotel assets in 2019.

Looking at the investor angle provides hope for the industry and a recovery. Our expectation, once the recovery gains momentum, is that a rebound will take place within six-to-twelve months. That said, there are questions around the timing of the recovery and whether it would be a relatively sharp hockey-stick rebound or a more drawn out and turbulent “W”-type recovery. Our original forecast for green shoots was mid-year, but all indications suggest we’re in for a longer run. At the same, markets with different demand fundamentals will recover at different speeds. Leisure travel confidence and demand will take longer to recover when benchmarked against business travel, which will potentially rebound quicker.

This outlook begs the question, what are investors seeing? On the debt side, leverage levels in Asia tend to be quite conservative at an LTV of around 50%. Lending is often relationship-driven, and the lenders have so far been quite supportive, extending waiving of breaches in loan covenants and offering flexibility in interest and capital repayments. That said, as the pressure in the system builds, the arrangement may change for some of the less well-capitalized hotels, or the banks themselves start coming under pressure.

Within the present environment, we do not see much distress, but owners are under pressure. As long as travel restrictions remain in place, the more difficult it will be to sustain the losses. In our view, we will likely see stress and distress in markets that are heavily reliant on leisure tourism and those which already had a supply and demand balance before COVID-19. This scenario may prompt investors to look more favourably on the hotel sector. Private equity is actively looking to capitalize on this environment and is seeking to invest across the capital stack, including in credit.

In markets such as Singapore and Hong Kong, we expect to see “priced-to-market” opportunities, but not distress. This trend may emerge from non-core would-be sellers of hotel real estate that had held high pricing expectations in the previous cycle and who may now show more flexibility in meeting buyers. Most owners in these markets are long-term players and have plenty of cash to carry them through. As one owner put it to me recently, “We are in the business of owning hotels for twenty, thirty years. We have had a good run, and we can sustain a few quarters of losses.”

Interestingly, in the last few weeks, several high net worth groups have indicated their intentions to set up a fund to acquire in distressed hotel assets. Although they are holding cash for now as they weather this storm, they are looking further ahead at opportunities and are ready to deploy if the pricing is right, which is positive.

While most transactions understandably remain on hold at present, we see the formation of a healthy pipeline. With plenty of investors holding their powder dry, we expect that once when travel restrictions are lifted, and some green shoots appear, we will see a flurry of investment activity across the region.

Until we can demonstrate a level of normality to business activity and pace of life, we’re going to see an impact on demand and growth. It’s difficult to call at this stage, though, as we’re still in the eye of the storm and every day brings new developments. But we take hope that investor interest, a rebound in arrivals over the medium-term and strong long-term fundamentals of the Asia Pacific hotel space, will ensure a recovery and position a healthy industry going forward.