Doing business in the Maldives

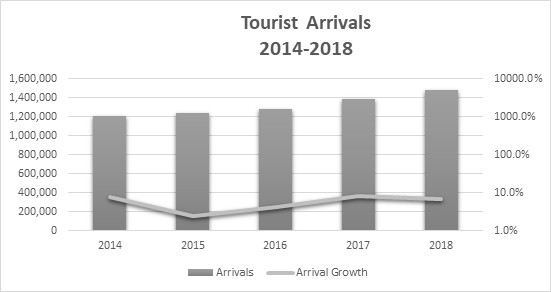

Tourism in the Maldives is still strong and resilient with positive tourist arrival growth rates over the recent years despite some occasional political, economic and social uncertainties. As per the statistics of Ministry of Tourism, a total of 1,484,274 international tourists arrived in the Maldives in 2018 maintaining a satisfactory growth rate of 6.8 per cent similar to the global tourist arrival growth rate of 6 per cent (1.4 billion tourists | UNWTO, 2019). The rest of the key demand-side indicators also showed improvement during the year with a 10.2 per cent increase in tourist bed nights, 1 per cent increase in average occupancy and a slight rise of 0.2 per cent in the average duration of stay.

Key Tourism Indicators 2018

| Number | % change (2018-2017) | |

| Tourist Arrival | 1,484,274 tourists | 6.8% |

| Bed nights | 9,471,177 | 10.2% |

| Occupancy Rate | 62.1% | 1.0% |

| Average Duration of Stay | 6.4 days | 0.2% |

| Operational Bed Capacity | 41,877 | 8.6% |

Source: Ministry of Tourism Maldives

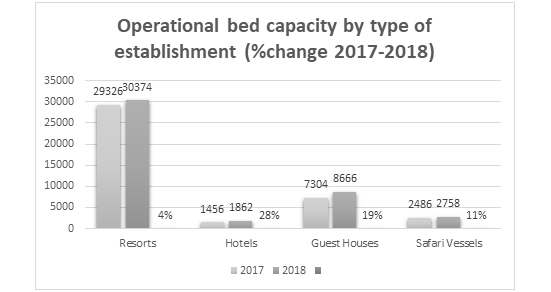

Moving to the supply side, the year 2018 noted an increase of 8.6 per cent in operational bed capacity. And, among the individual types of tourist accommodation facilities, the highest increment (28 per cent) in operational bed capacity was seen from hotels while a 19 per cent, 11 per cent and 4 per cent raises were noted for guest houses, safari vessels and resorts, respectively.

Economic Impact of Tourism Sector

| Maldives (% share) | World (% share) | |

| GDP | 7.6% growth rate | |

| GDP Direct Contribution | 39.6% | 3.2% |

| GDP total contribution | 76.6% | 10.4 |

| Employment direct contribution | 16% | 3.8 |

| Employment total contribution | 37.4% | 9.9 |

| Visitor Exports- contribution to total exports | 74.7% | 6.5 |

| Travel and Tourism contribution to capital investment | 29.6% | 4.5 |

Source: Economic Impact 2018, WTTC

The strong and sustainable performance of the tourism sector in 2018 is one of the main reasons for the robust growth in the Gross Domestic Product (GDP) with a rate of 7.6 per cent (MMA, 2019) last year. The Maldivian economy is heavily dependent on the tourism industry as 39.6 per cent of the GDP came directly from the tourism sector in 2017 as per the most recent economic impact report by World Travel and Tourism Council (WTTC). Also, the total contribution to the GDP by the industry added up to 76.6 per cent with the multiplier effect of direct, indirect and induced contribution.

The tourism sector’s substantial contribution to the national economic growth is further reflected from the total exports in 2017 with 74.7 per cent being visitor exports. Moreover, 29.6 per cent of the national capital investments accounted for the tourism sector. Lastly, in the same year, 16 per cent (34,500) of employment came from the tourism industry directly and while 37.4 per cent (80,500) was the total employment contribution from the sector. And, these figures are forecasted to be similar for 2018 by WTTC.

Ease of Doing Business Indicators 2019

| Indicators | Doing Business (rank from 1 to 191) | Change in rank | Distance to frontier (Score from 0 to 100) | Change in score | Regional Average (South Asia) |

| Starting a Business | 71 | -3 | 89.17 | 0.11 | 85.44 |

| Dealing with Construction Permits | 62 | -8 | 73.00 | 0.13 | 61.85 |

| Getting Electricity | 145 | -2 | 55.60 | 1.91 | 59.36 |

| Registering Property | 175 | -1 | 39.97 | 0 | 46.91 |

| Getting Credit | 134 | -1 | 35.00 | 0 | 47.50 |

| Protecting Minority Investors | 132 | 0 | 43.33 | 0 | 61.67 |

| Paying Taxes | 117 | 1 | 66.42 | 0.34 | 60.02 |

| Trading Across Borders | 155 | -3 | 55.87 | 0 | 62.57 |

| Enforcing Contracts | 125 | -19 | 52.47 | -2.6 | 43.44 |

| Resolving Insolvency | 139 | 0 | 33.48 | 0.22 | 38.30 |

Source: Doing Business 2018: Maldives, The World Bank Group

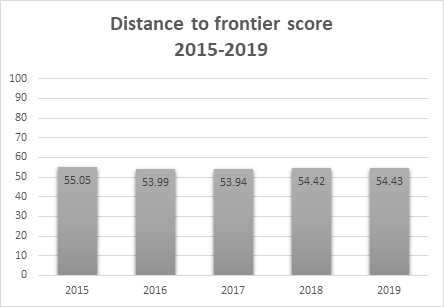

As the tourism sector plays a major role in national economic development, promoting businesses, entrepreneurship and investments are crucial in driving the tourism industry. However, with a continued drop in the Doing Business Rank, the Maldives appears to be slow in bringing the necessary regulatory reforms in stimulating a favourable business climate in the country.

The World Banks’ Ease of Doing Business ranking is a valuable instrument in analysing the national business environment, understanding global best practices and implementing better and more relaxed policies and procedures. The doing business index is a quantitative measure, which evaluates eleven key aspects in the lifecycle of a typical business operation which are starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency and labour market regulations.

According to the latest report published by the World Bank, the Maldives ranked 139 in doing business among the 191 countries studied while the distance to frontier score (or DTF measures the absolute progress in a particular indicator and how far the economy is from the frontier from a scale of 0 to 100) stood at 54.43, which is below the regional average score of 56.71.

Studying the individual indicators of the doing business rankings, the Maldives has only improved in the area of paying taxes by moving up just one rank. However, ranked under 100 and a DTF score higher than the regional average of South Asia, procedures in starting a business and getting construction permits seems to be comparatively easier in the Maldives. In contrast, the Maldives is way behind in terms of registering property with a rank of 175 and a DTF score far less than the regional average.

Furthermore, the country has fallen behind by 19 ranks in terms of enforcing contracts which could hinder investor protection and good governance. Also, the Maldives is comparatively weak in the areas of getting electricity, trading across borders and resolving insolvency. Such excessive regulatory procedures in cross-border trading can increase logistics costs, reduce port efficiency and hinder regional economic development. Also, complex insolvency and liquidation procedures can increase the cost of bankruptcy and lower recovery rate of creditors.

Therefore, in order to enhance entrepreneurship and foster a conducive business environment especially for small and medium enterprises, it is crucial for the government and policy makers to undertake the required reforms. Lenient and less cumbersome procedures in starting and operating a business could create a viable market place and encourage competition. Additionally, easily obtainable credit information will result in a strong financial system, lower rates of interest and better access to finance by businesses.

Nonetheless, for a small economy like the Maldives, a huge move up in the rank could still be too ambitious and far-fetched. Also, there are some other country-specific factors that are not considered in the doing business index such as the availability of skilled labour, market size, issues with logistics and transportation and other geodemographic factors which are important in making a business decision. Yet, lesser bureaucratic hindrances, a strengthened legal environment and benchmarking of good international business practices can enhance investments, entrepreneurship and economic prosperity.