How to Perform Hotel Market Research

No plan is viable without some form of research. Especially if you require outside investment you will need to demonstrate you have done a hotel market study for your new hotel concept. It will also be helpful for you to put your ideas on paper and benchmark them against the market to determine the chance of success. Based on our hotel management company´s experience we have put some pointers on paper.

Having opened various hotels we have noticed that many entrepreneurs make decisions based on assumptions when it comes to their new hotel concept. This could be very dangerous as any unforeseen change you might have to implement at a later stage due to a false assumption could bring with it additional costs that will have a negative impact on your bottom line.

Especially if you have raised capital investment from banks or other lenders, this puts you in a difficult predicament, as it might not be possible to pay off loans in the time frames agreed, or ROI will not reach the expected levels. Pressure will subsequently mount to make other changes to your concept to recuperate and offset the additional costs. Such changes might even affect the uniqueness of your original concept, but you will have no choice but to compromise and please investors.

A typical example we face is that operators would like to save on staffing costs by selling rooms at rates including breakfast. Offering room-only prices does not fit in their cost structure and PnL forecast, as staffing numbers need to be kept low. However if a market study uncovers that all competitors offer room-only rates. This would put a hotel at a significant disadvantage, and make the hotel less competitive as price is among the key selection factors by consumers.

The assumption to simplify operations and include breakfast in the room price in order to save on operational costs is understandable. But you have to ensure that it is sustainable from a commercial perspective and benchmark your idea against the market.

Another classic example is hotel companies that want to enter the market with a flat rate structure. In essence from a positioning perspective, it sounds great. You will attract a lot of consumer attention by offering such transparency. However in reality, as hotel markets are driven mostly by dynamic rates which fluctuate with demand (a bit like the stock market), you will find your hotel out-priced by competitors in low season

So, how to prepare and avoid these kinds of situations? You will have to do thorough market research and perform a hotel market analysis.

How to Assess Market Performance

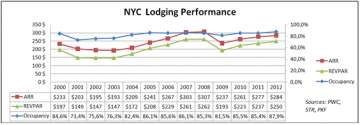

Let’s start with a generic market study. You need to obtain statistics on occupancy, average rate, and revenues of the surrounding area of your hotel. If you get data for the last few years of similar hotels in your market you will get a good idea of how the market is evolving, giving you a rough perspective of what kind of overall results would be possible.

You can obtain data like this by researching the internet as much data is published in press releases. To get exact numbers you should contact consulting companies like PWC, STR, and HVS. They are specialized in collecting hotel market performance statistics and trends.

Understand Business Sources

What creates demand in your market? Why do travelers come to your destination? What is the motive for their trip? Where are they coming from, or rather, what are your feeder markets? These are all questions that need to be answered. Your local tourist organization or hotel marketing agency will probably be able to provide you with valuable market statistics. But also go on the website of nearby airports, it will provide you with interesting statistics in terms of passenger data. You need to understand your sources of business and market segments to be able to make an effective marketing plan.

Competitive Analysis

Next step, you need to make a detailed overview of your competition. We differentiate competitors into 2 groups. First, we look at conceptual competitors that have a concept that is similar or comparable to yours in essence. And second, there are proximity competitors that are in your immediate surroundings and this will be your local competition.

Start with building a summary outlining in detail:

- hotel name

- concept type

- number of rooms

- star rating

- chain affiliation

- address

- area

- all facilities

- website URL

- website languages

- online reputation and review scores

- price range and average rate (see Google Hotel Finder and TripAdvisor)

Add notes with anything that is unique about their operations, or service that differentiates them from the rest. It will help you at a later stage in defining a competitive strategy.

It would be good if you can get monthly performance data on the individual hotels as well. You will gain a valuable understanding of the seasonal fluctuations of the market.

Development Pipeline

What other hotels are planned to be constructed and open in your immediate area? How many rooms will be added? How will this impact your market share and financial results?

These are all very relevant questions that cannot be ignored. And investors will be extremely interested. Mind you, if an area is popular and many new hotels are planned it can have a positive effect as well, and increase overall demand.

Profit & Loss Statement

The key question as always is how much money will your hotel make. Investors are logically keen to know what kind of return on investment to expect.

Based on your market research and competitive analysis you will need to make a founded estimation of what kind of occupancy and average room rate your new hotel can generate. You will need to make a 5-year forecast.

I would advise being prudent and conservative. Don’t put numbers on paper that investors would like to see, but make an achievable forecast. Add revenue and cost predictions from all operational departments (restaurant, bar, banquets, front office, housekeeping, engineering, etc) to get to your GOP (gross operating profit).

Include the undistributed, fixed, and overhead costs to get to your NOI (net operating income) or EBITDA (Earnings Before Interest Taxes Depreciation). This is basically the profit generated from the hotel’s own operations.

To estimate costs you can use local industry standards as a benchmark. I would recommend creating a staffing schedule for each department to simulate your cost and ensure you are at the right level. You can’t afford big mistakes, as your profit would change radically and you would not be able to achieve the ROI you sold to investors.

A version of this article originally posted on XOTELS

Featured Image: Pixabay