Reopening the Maldives, what it means for hoteliers

The Maldives Ministry of Tourism recently announced that the country will begin in July a phased reopening of the country’s borders to international visitors. For hoteliers, that means the race to regain market share shrunken by COVID-19 is about to begin.

In the pre-pandemic world, Maldives was one of the top global markets for generation of revenue per available room (RevPAR), mainly because of growth in average daily rate (ADR). The remainder of 2020 will be different, however, with more competition for the higher occupancy levels needed to keep hotel operations and cashflow afloat.

The demand needed to achieve higher occupancy will be largely dictated by policy measures defined by the Maldives Tourism Ministry as well as guidelines from top source markets that can affect traveller confidence.

Currently, most of the Maldives’ top source countries, such as China, India, Germany, the U.K., Italy, and France, require a 14-day quarantine for travellers upon return to their respective home countries. These guidelines do not have a specified end date and could restrict traveller sentiment when they consider the return phase of any international trip.

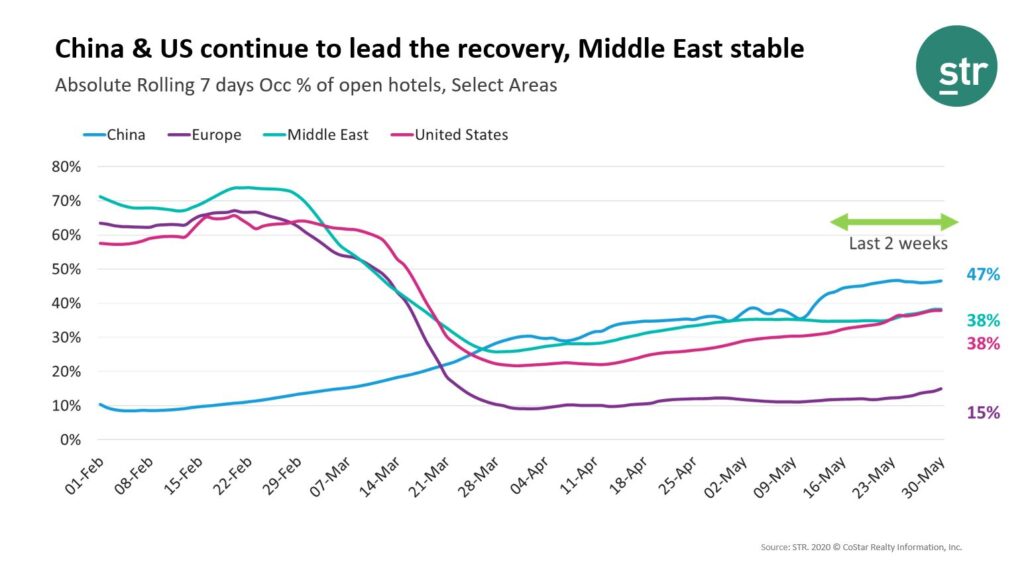

As we anticipate hotel performance recovery, it is important to look in the performance trends of source markets that are at different points of the reopening timeline compared with the Maldives.

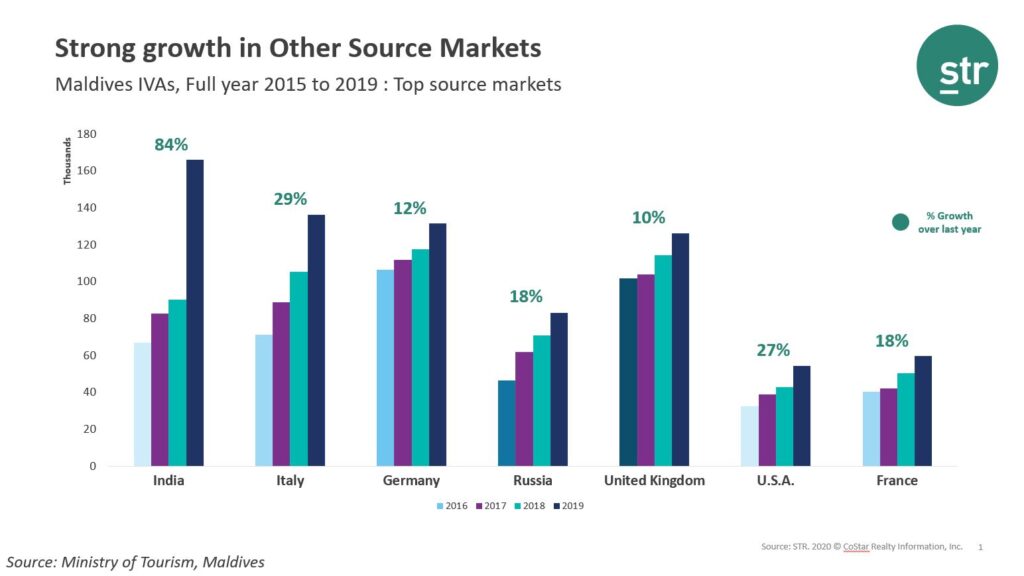

As noted in the chart below, Maldives has seen a shift in its key visitor feeder markets over the last two years, with less reliance on Chinese tourists.

The furthest ahead in the pandemic timeline, China leads global hotel performance recovery with occupancy nearing 50% in late May thanks to returned leisure and business demand. Domestic tourism in China has grown over the last three years with the Chinese government creating infrastructure to boost that segment. Moving forward, there is uncertainty around the Chinese outbound travel market and its role in the long-term global tourism recovery.

Hotel occupancy in the U.S. and UAE has trended upward, but hotels in the U.K. and Europe continue to struggle with sluggish demand as the continent is further behind in the lockdown timeline.

India has emerged as one of the strongest growing source markets for the Maldives over the last few years, but that country is reeling under the pressure from the government-imposed lockdown and no signs of opening international borders in the immediate future.

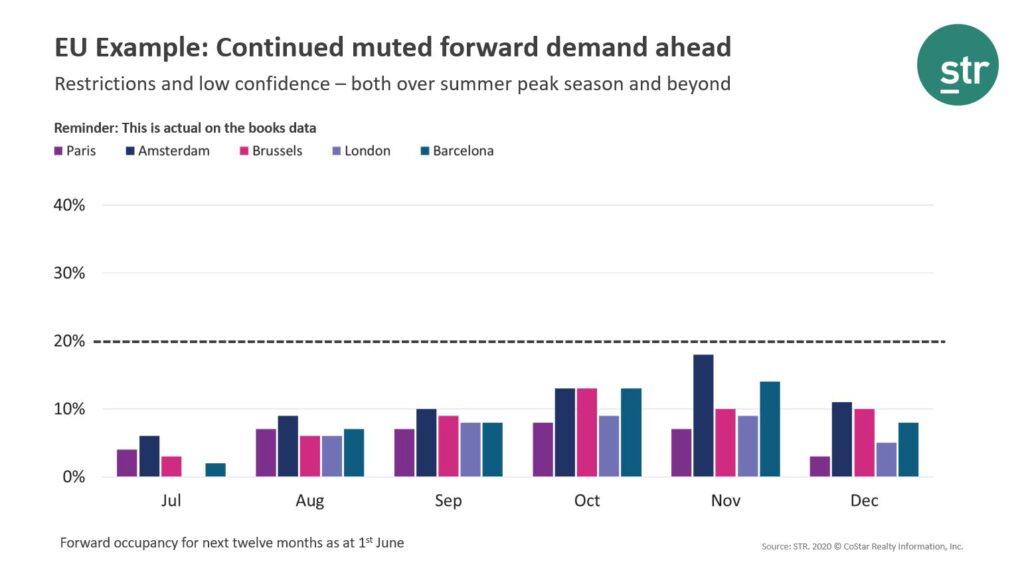

Through our Forward STAR product, we can supplement recent historical data with a look into the future in some areas of the world. Business on books for the U.K. and Europe also paints a bleak picture on any immediate revival in demand.

In the Maldives, some luxury and upper upscale hotels are seeing business on books starting to return for September, but with airlines facing structural changes, flight routes to the Maldives will also play an important part in generating demand.

When demand does return, from which point will hotels in the Maldives be starting?

Most of the country’s hotels have experienced cashflow challenges due to temporary closures and local banks being unable to lend. The key for hotels in Maldives will be striking the delicate balance between safety, hospitality and protecting the bottom line.

Competition for market share will continue to be strong as recent inventory expansion is likely to add pressure on market performance levels. The development pipeline for Maldives remains strong even with some project delays imminent. Most of the new supply coming online is hitting the upscale and upper upscale classes, and more properties will move more towards an “affordable luxury” experience to accommodate family travels and capture the inherent advantage of social distancing. Fortunately, the destination can leverage its isolated nature and geographical dispersion to navigate evolving travel conditions in a COVID-19 world.

Main Feature Image credits: Sebastian Pena Lambarri – Unsplash.com

Vidhi Godiawala is the Business Development Manager, Central and South Asia, STR.